TAX PROBLEMS DON'T SOLVE THEMSELVES.

IRS Letters. deadlines. Sleepless nights.

Let's fix this, together.

Every tax situation is different.

Whether you’re dealing with IRS notices, unfiled returns, back taxes, or need ongoing financial support, we offer solutions designed to meet you where you are & guide you forward.

New Paragraph

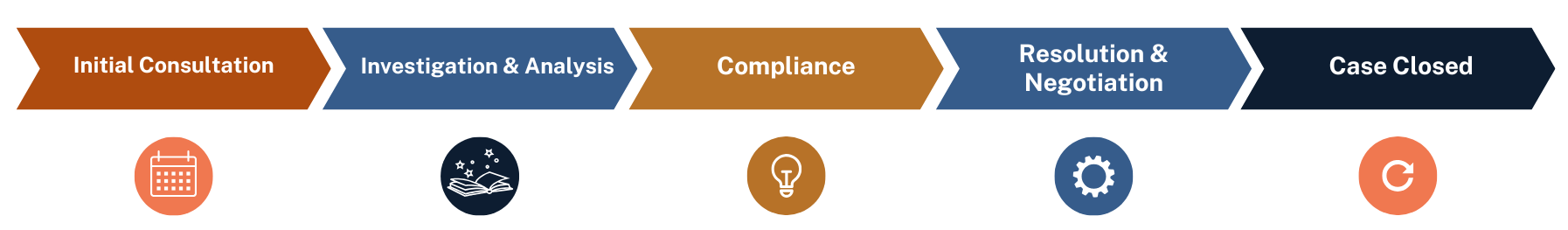

IRS Tax Debt Relief

"Representation and negotiation to resolve IRS tax problems & enforcement actions."

Bookkeeping/Accounting

"Ongoing financial support to keep your business compliant, organized, & informed."

BUSINESS CONSULTING

"Strategic guidance to help business owners make confident, informed decisions."

MEET KIM.

IRS Enrolled Agent • Certified Fraud Examiner • 15+ Years Experience

Kim Shepherd is the founder of In-Sync Accounting & Consulting, LLC, where she has built a reputation for helping clients navigate complex tax situations with confidence & clarity.

As an IRS Enrolled Agent & Certified Fraud Examiner with over 15 years of experience, Kim understands how overwhelming IRS issues can be, & how important it is to have an advocate who listens, explains, & leads with integrity.

She specializes in accounting, tax debt resolution/representation, & consulting services tailored to individuals and business owners who want clear answers, practical solutions, and long-term peace of mind.

“Kim is known for her calm, compassionate approach during stressful IRS situations.”

WHILE YOU WAIT...

Interest and penalties continue to grow daily.

IRS enforcement actions, such as wage garnishments, bank levies, or property seizures, remain possible.

Delaying action often means paying more & carrying unnecessary stress.

ACTING NOW MEANS...

The opportunity to pause IRS enforcement actions.

Potentially reduce or eliminate penalties and interest.

Regain control of your finances & peace of mind.

*Results depend on individual circumstances.